21 Conditional variance processes

A stochastic process for the conditional variance can be used to specify a model of the form

21.1 ARCH(p) process

The auto regressive and conditionally heteroskedastic process (ARCH) were introduced in 1982 by Robert Engle (Engle (1982)) to model the conditional variance of a time series. It is often an empirical fact in economics that the larger values of time series the larger the variance. Let’s define an ARCH process of order

21.1.1 Moments

Proposition 21.1 The conditional mean of an ARCH(p) process (Equation 21.1) is equal to

Proposition 21.2 The conditional variance of an ARCH(p) process (Equation 21.1) is not stochastic given the information at time

The long-term (unconditional) expectation of the ARCH(p) variance

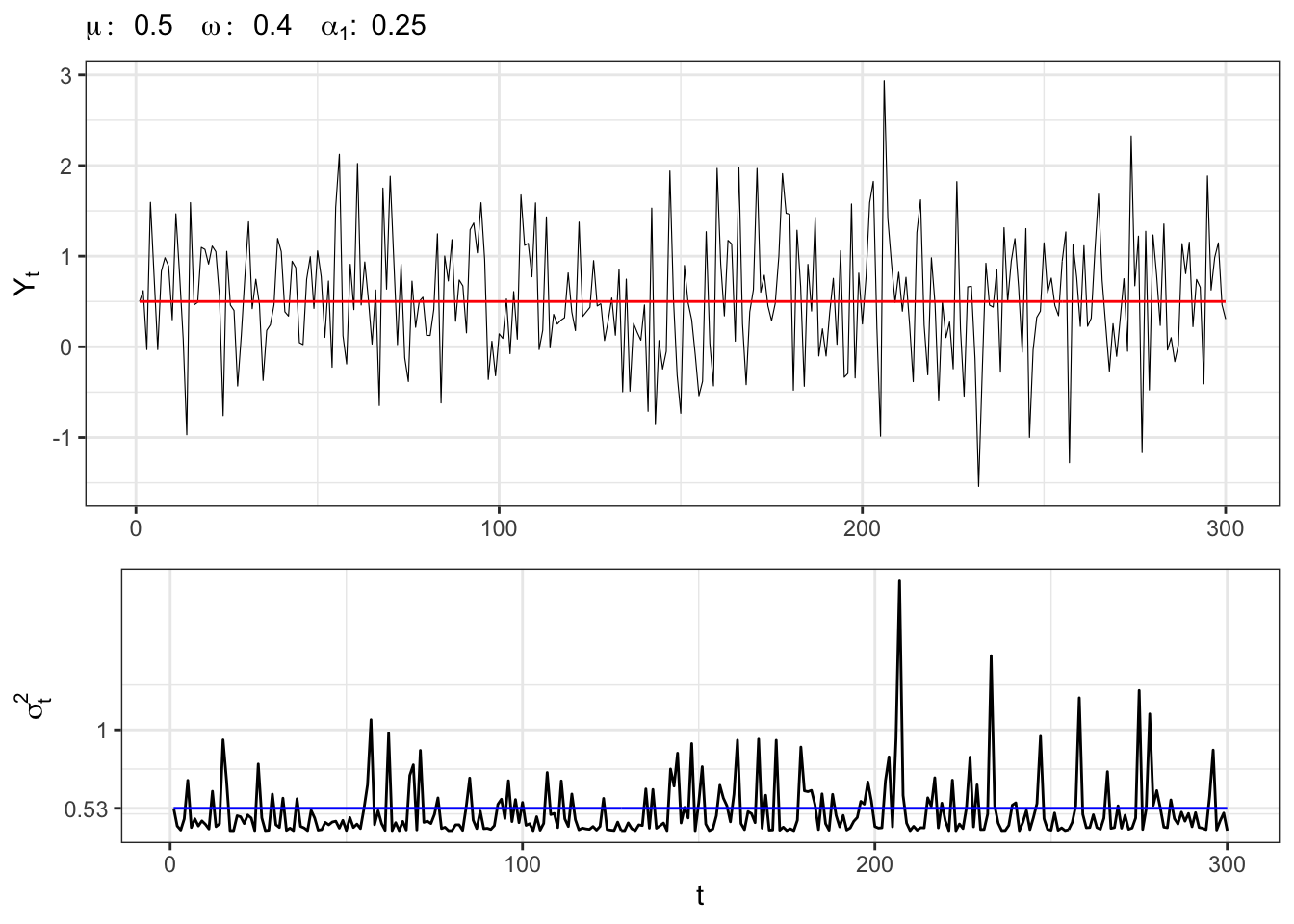

Example 21.1 Let’s simulate an ARCH(1) process with normal residuals, i.e.

ARCH(1) simulation

# Random seed

set.seed(1)

# *************************************************

# Inputs

# *************************************************

# Number of simulations

t_bar <- 300

# Long term mean of Yt

mu <- 0.5

# Intercept sigma2

omega <- 0.4

# ARCH parameters

alpha <- c(alpha1 = 0.25)

# *************************************************

# Simulation

# *************************************************

# Long-term variance

e_sigma2 <- omega / (1 - sum(alpha))

# Starting point

Yt <- rep(mu, 2)

# Initialization

sigma2_t <- rep(e_sigma2, 4)

# Simulate standardized residuals

u_t <- rnorm(t_bar, 0, 1)

# Initialize residuals

e_t <- sigma2_t * u_t

for(t in 2:t_bar){

# ARCH components

sum_arch <- alpha[1] * e_t[t-1]^2

# Next-step variance

sigma2_t[t] <- omega + sum_arch

# Update simulated residuals

e_t[t] <- sqrt(sigma2_t[t]) * u_t[t]

# Update time series

Yt[t] <- mu + e_t[t]

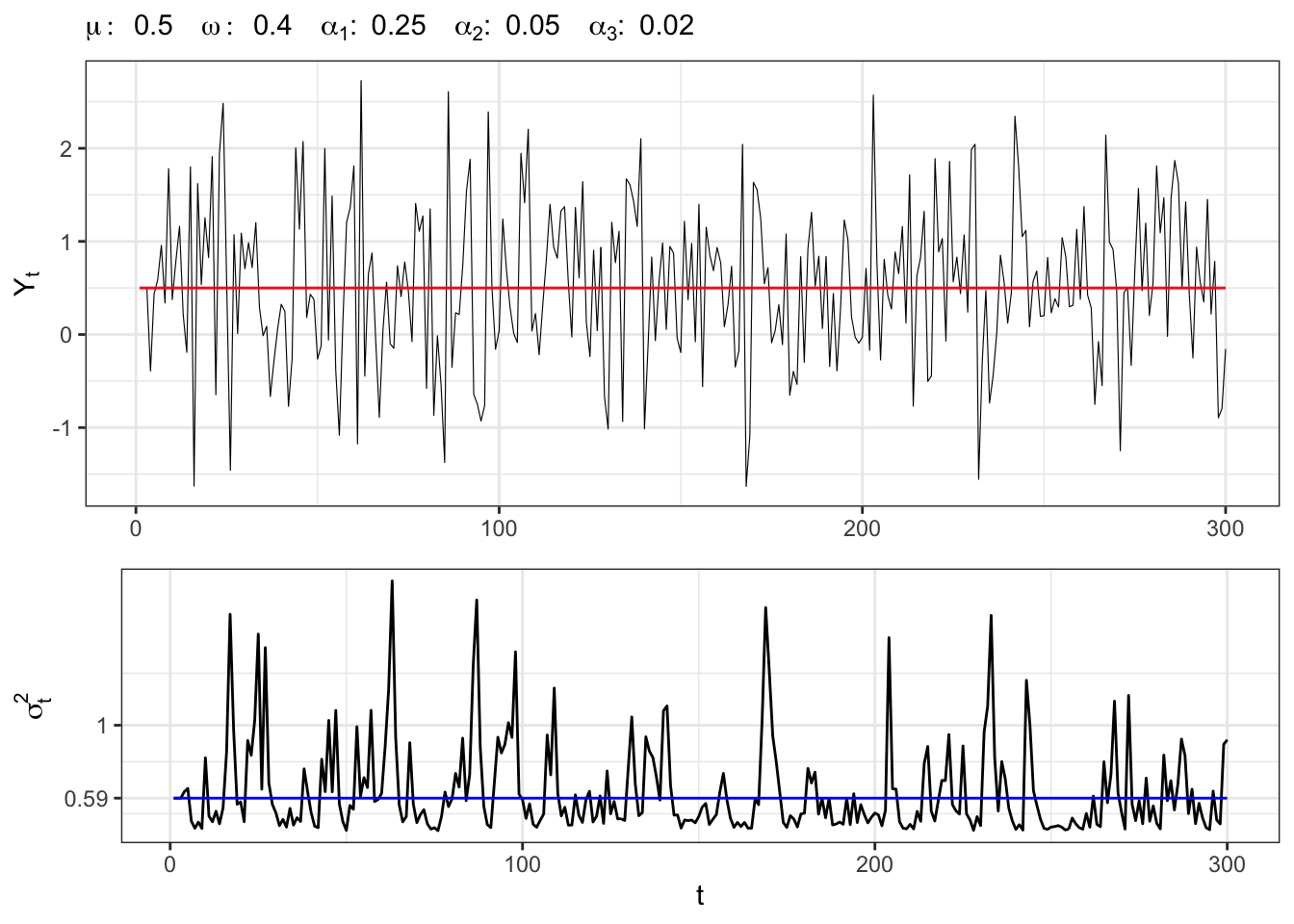

}Example 21.2 Let’s simulate an ARCH(3) process with normal residuals, i.e.

ARCH(3) simulation

# Random seed

set.seed(2)

# *************************************************

# Inputs

# *************************************************

# Number of simulations

t_bar <- 300

# Long term mean of Yt

mu <- 0.5

# Intercept sigma2

omega <- 0.4

# ARCH parameters

alpha <- c(alpha1 = 0.25, alpha2 = 0.05, alpha3 = 0.02)

# *************************************************

# Simulation

# *************************************************

# Long-term variance

e_sigma2 <- omega / (1 - sum(alpha))

# Starting point

Yt <- rep(mu, 4)

# Initialization

sigma2_t <- rep(e_sigma2, 4)

# Simulate standardized residuals

u_t <- rnorm(t_bar, 0, 1)

# Initialize residuals

e_t <- sigma2_t * u_t

for(t in 4:t_bar){

# ARCH components

sum_arch <- alpha[1] * e_t[t-1]^2 + alpha[2] * e_t[t-2]^2 + alpha[3] * e_t[t-3]^2

# Next-step variance

sigma2_t[t] <- omega + sum_arch

# Update simulated residuals

e_t[t] <- sqrt(sigma2_t[t]) * u_t[t]

# Update time series

Yt[t] <- mu + e_t[t]

}21.2 GARCH(p,q) process

As done with the ARCH(p), with generalized auto regressive conditional heteroskedasticity (GARCH) we model the dependency of the conditional second moment. It represents a more parsimonious way to express the conditional variance. A GARCH(p,q) processx is defined as:

Regarding the variance, the long-term expectation of

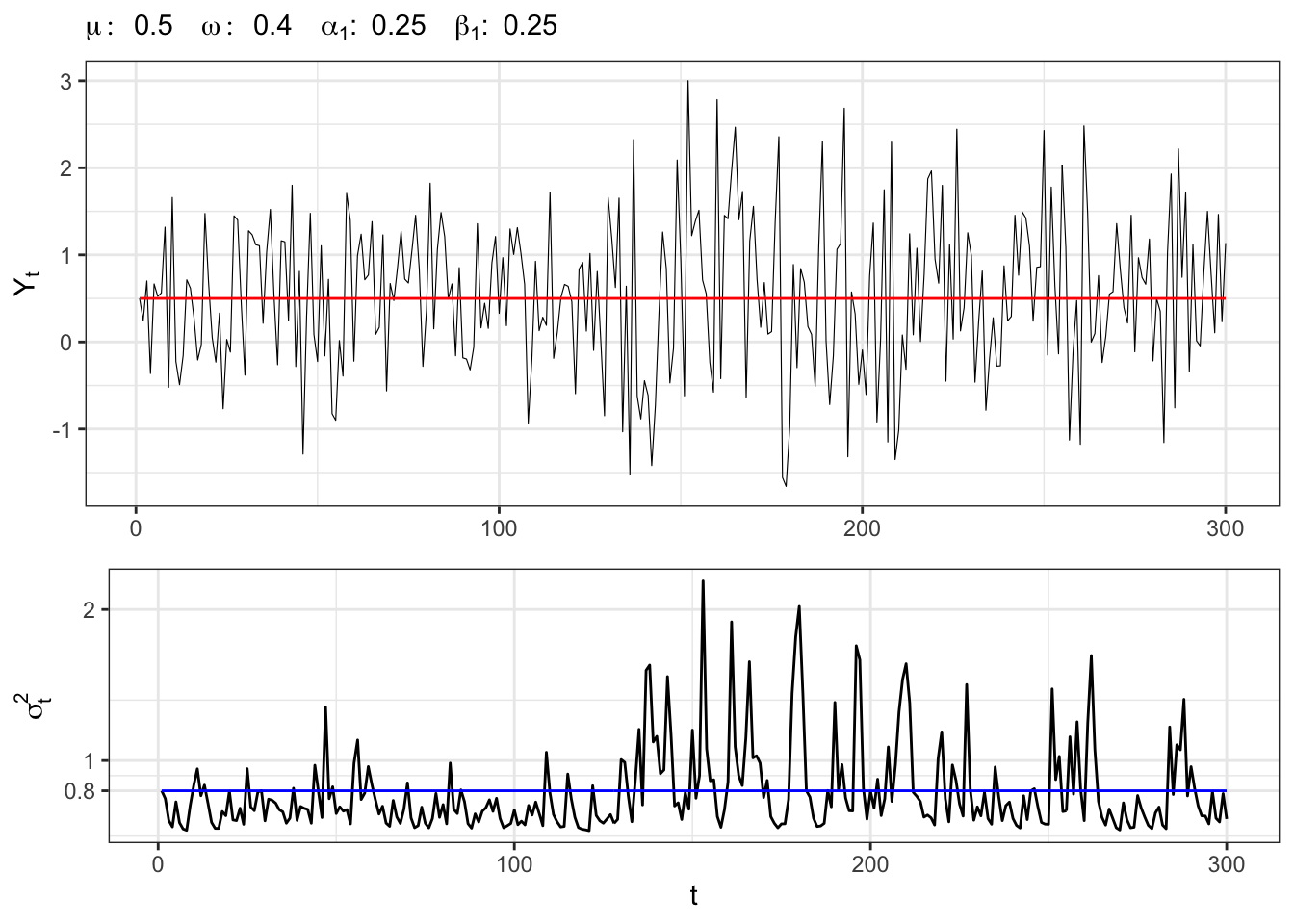

Example 21.3 Let’s simulate an GARCH(1,1) process with normal residuals, i.e.

GARCH(1,1) simulation

# Random seed

set.seed(3)

# *************************************************

# Inputs

# *************************************************

# Number of simulations

t_bar <- 300

# Long term mean of Yt

mu <- 0.5

# Intercept sigma2

omega <- 0.4

# ARCH parameters

alpha <- c(alpha1 = 0.25)

# GARCH parameters

beta <- c(beta1 = 0.25)

# *************************************************

# Simulation

# *************************************************

# Long-term variance

e_sigma2 <- omega / (1 - sum(alpha) - sum(beta))

# Starting point

Yt <- rep(mu, 2)

# Initialization

sigma2_t <- rep(e_sigma2, 4)

# Simulate standardized residuals

u_t <- rnorm(t_bar, 0, 1)

# Initialize residuals

e_t <- sigma2_t * u_t

for(t in 2:t_bar){

# ARCH components

sum_arch <- alpha[1] * e_t[t-1]^2

# GARCH components

sum_garch <- beta[1] * sigma2_t[t-1]

# Next-step variance

sigma2_t[t] <- omega + sum_arch + sum_garch

# Update simulated residuals

e_t[t] <- sqrt(sigma2_t[t]) * u_t[t]

# Update time series

Yt[t] <- mu + e_t[t]

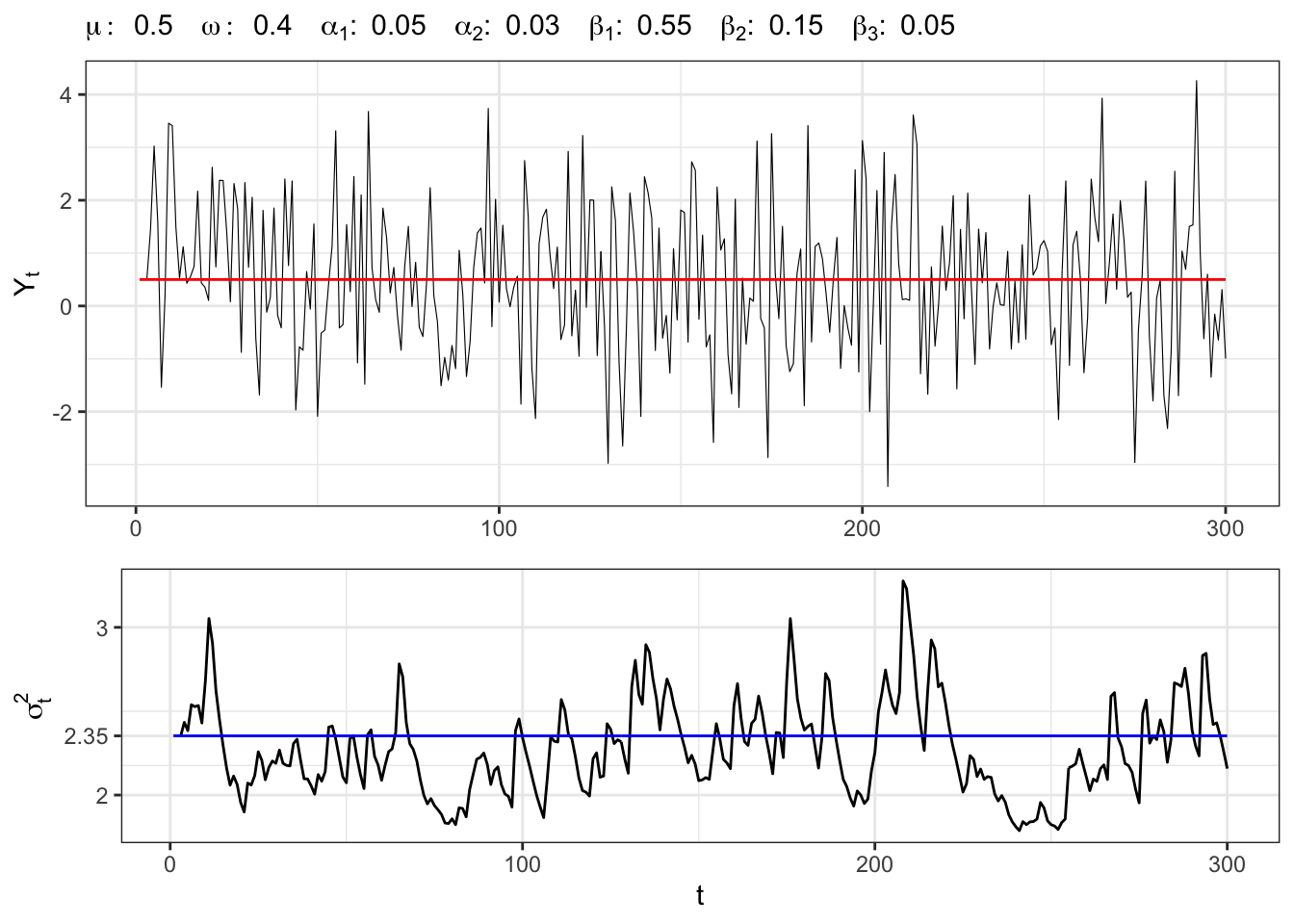

}Example 21.4 Let’s simulate a GARCH(2,3) process with normal residuals, i.e

GARCH(2,3) simulation

# Random seed

set.seed(4)

# *************************************************

# Inputs

# *************************************************

# Number of simulations

t_bar <- 300

# Long term mean of Yt

mu <- 0.5

# Intercept sigma2

omega <- 0.4

# ARCH parameters

alpha <- c(alpha1 = 0.05, alpha2 = 0.03)

# GARCH parameters

beta <- c(beta1 = 0.55, beta2 = 0.15, beta3 = 0.05)

# *************************************************

# Simulation

# *************************************************

# Long-term variance

e_sigma2 <- omega / (1 - sum(alpha) - sum(beta))

# Starting point

Yt <- rep(mu, 4)

# Initialization

sigma2_t <- rep(e_sigma2, 4)

# Simulate standardized residuals

u_t <- rnorm(t_bar, 0, 1)

# Initialize residuals

e_t <- sigma2_t * u_t

for(t in 4:t_bar){

# ARCH components

sum_arch <- alpha[1] * e_t[t-1]^2 + alpha[2] * e_t[t-2]^2

# GARCH components

sum_garch <- beta[1] * sigma2_t[t-1] + beta[2] * sigma2_t[t-2] + beta[3] * sigma2_t[t-3]

# Next-step variance

sigma2_t[t] <- omega + sum_arch + sum_garch

# Update simulated residuals

e_t[t] <- sqrt(sigma2_t[t]) * u_t[t]

# Update time series

Yt[t] <- mu + e_t[t]

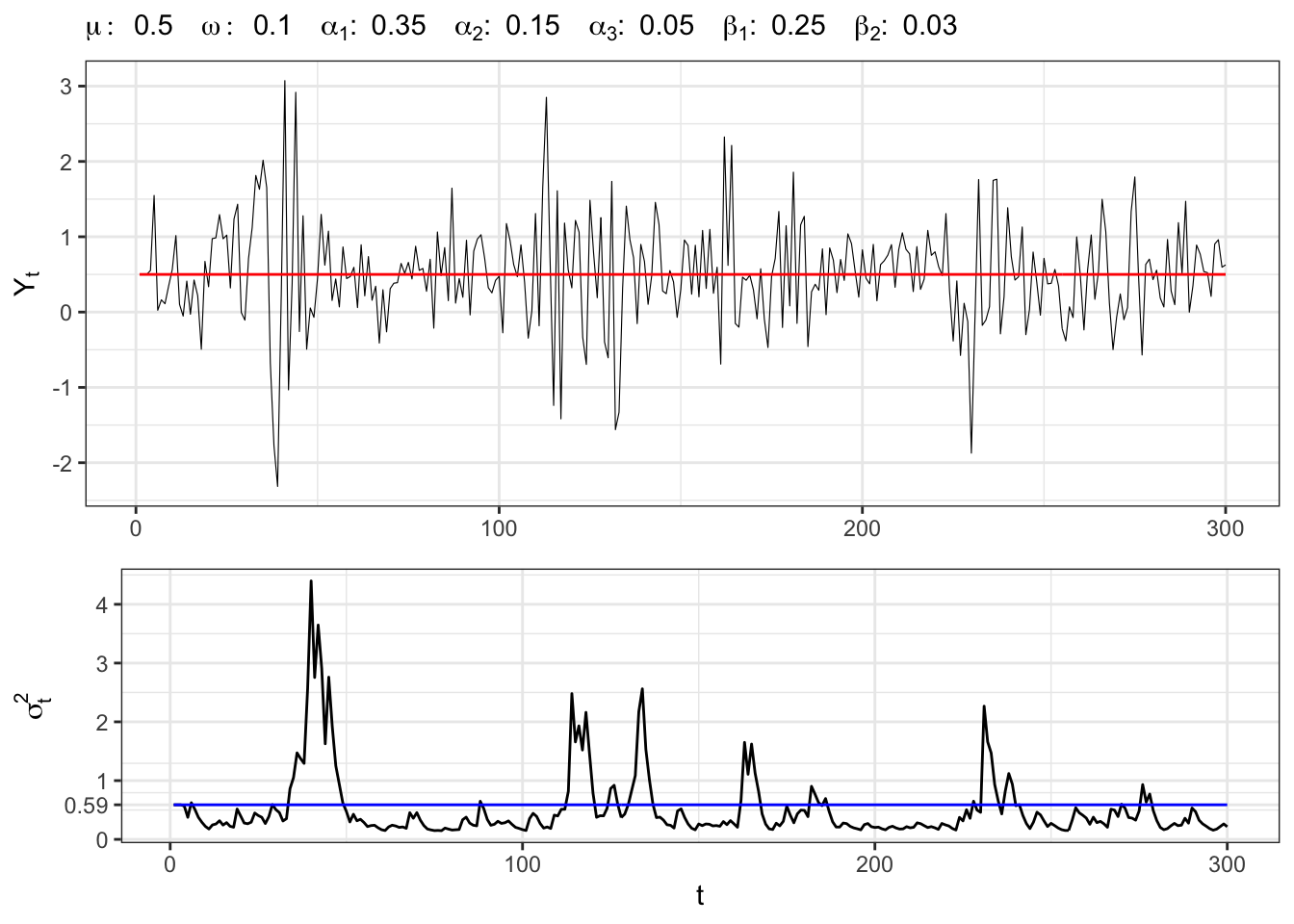

}Example 21.5 Let’s simulate a GARCH(3,2) process with normal residuals, i.e.

GARCH(3,2) simulation

# Random seed

set.seed(5)

# *************************************************

# Inputs

# *************************************************

# Number of simulations

t_bar <- 300

# Long term mean of Yt

mu <- 0.5

# Intercept sigma2

omega <- 0.1

# ARCH parameters

alpha <- c(alpha1 = 0.35, alpha2 = 0.15, alpha3 = 0.05)

# GARCH parameters

beta <- c(beta1 = 0.25, beta2 = 0.03)

# *************************************************

# Simulation

# *************************************************

# Long-term variance

e_sigma2 <- omega / (1 - sum(alpha) - sum(beta))

# Starting point

Yt <- rep(mu, 4)

# Initialization

sigma2_t <- rep(e_sigma2, 4)

# Simulate standardized residuals

u_t <- rnorm(t_bar, 0, 1)

# Initialize residuals

e_t <- sigma2_t * u_t

for(t in 4:t_bar){

# ARCH components

sum_arch <- alpha[1] * e_t[t-1]^2 + alpha[2] * e_t[t-2]^2 + alpha[3] * e_t[t-3]^2

# GARCH components

sum_garch <- beta[1] * sigma2_t[t-1] + beta[2] * sigma2_t[t-2]

# Next-step variance

sigma2_t[t] <- omega + sum_arch + sum_garch

# Update simulated residuals

e_t[t] <- sqrt(sigma2_t[t]) * u_t[t]

# Update time series

Yt[t] <- mu + e_t[t]

}21.3 IGARCH

Many variants of the standard GARCH process were developed in literature. For example, the Integrated Generalized Auto regressive Conditional heteroskedasticity (IGARCH(p,q)) is a restricted version of the GARCH, where the persistent parameters sum up to one, and imply a unit root in the GARCH process with the condition

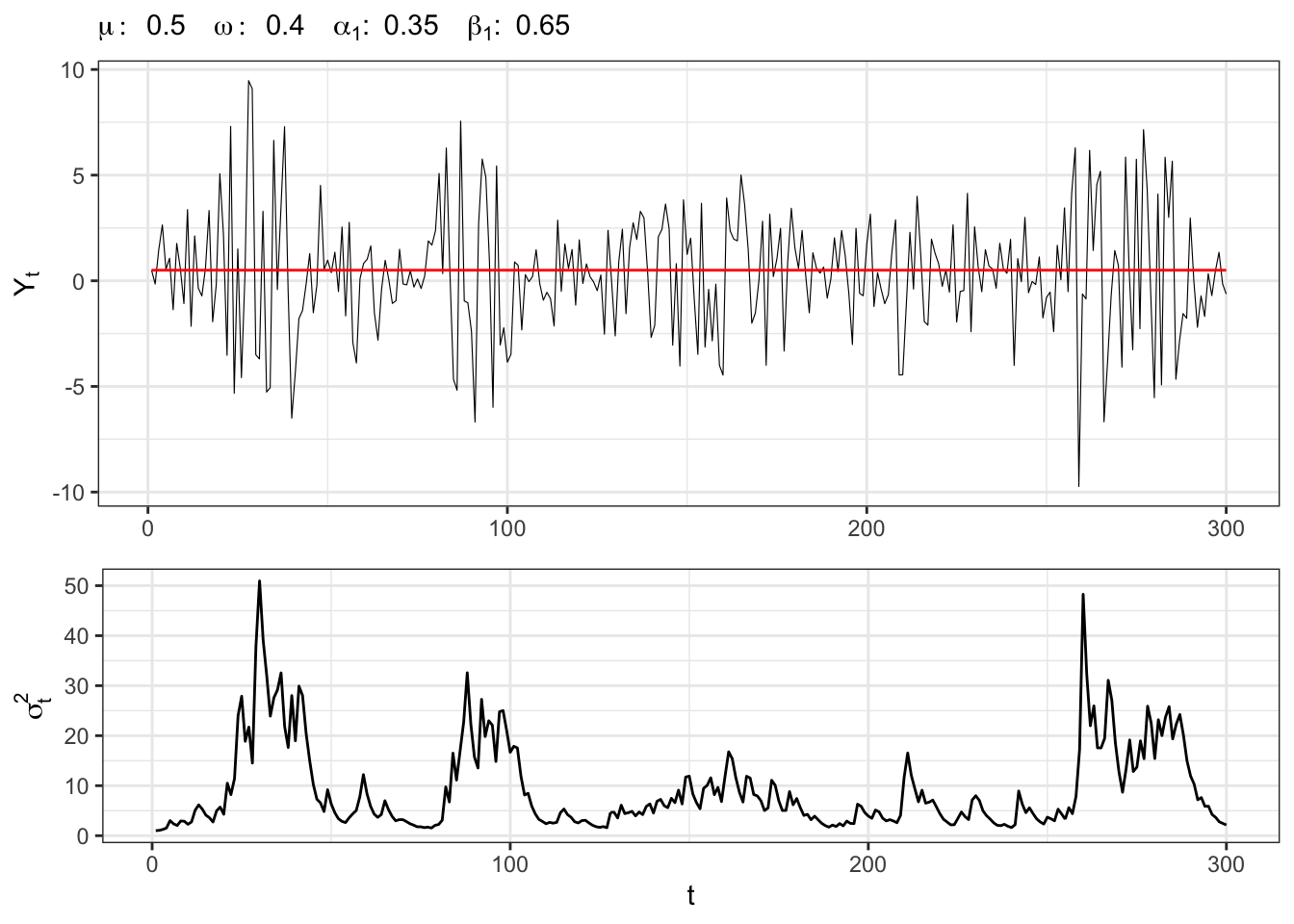

Example 21.6 Let’s simulate an iGARCH(1,1) process with normal residuals, i.e.

iGARCH(1,1) simulation

# Random seed

set.seed(6)

# *************************************************

# Inputs

# *************************************************

# Number of simulations

t_bar <- 300

# Long term mean of Yt

mu <- 0.5

# Intercept sigma2

omega <- 0.4

# ARCH parameters

alpha <- c(alpha1 = 0.35)

# *************************************************

# Simulation

# *************************************************

# Starting point

Yt <- rep(mu, 2)

# Initialization

sigma2_t <- rep(1, 2)

# Simulate standardized residuals

u_t <- rnorm(t_bar, 0, 1)

# Initialize residuals

e_t <- sigma2_t * u_t

for(t in 2:t_bar){

# ARCH components

sum_arch <- alpha[1] * e_t[t-1]^2

# GARCH components

sum_garch <- (1 - alpha[1]) * sigma2_t[t-1]

# Next-step variance

sigma2_t[t] <- omega + sum_arch + sum_garch

# Update simulated residuals

e_t[t] <- sqrt(sigma2_t[t]) * u_t[t]

# Update time series

Yt[t] <- mu + e_t[t]

}21.4 GARCH-M

The GARCH in-mean (GARCH-M) model adds a stochastic term into the mean equation. This is motivated especially in financial theories (e.g., risk-return trade-off) suggesting that expected returns may depend on volatility, i.e.

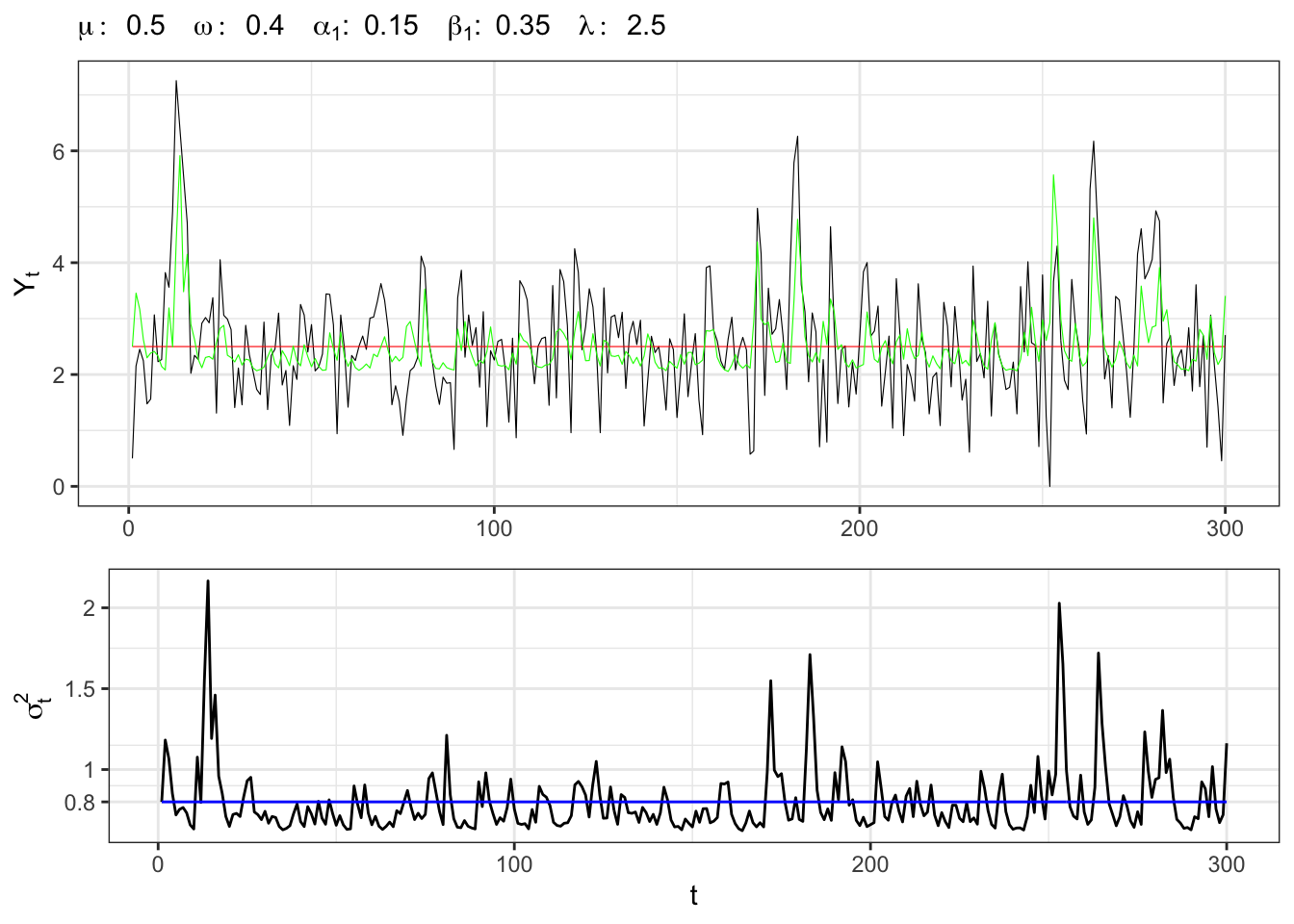

Example 21.7 Let’s simulate an GARCH-M(1,1) process with normal residuals, i.e.

GARCH-M(1,1) simulation

# Random seed

set.seed(7)

# *************************************************

# Inputs

# *************************************************

# Number of simulations

t_bar <- 300

# Long term mean of Yt

mu <- 0.5

# Intercept sigma2

omega <- 0.4

# ARCH parameters

alpha <- c(alpha1 = 0.15)

# Mean param

lambda <- 2.5

# GARCH parameters

beta <- c(beta1 = 0.35)

# *************************************************

# Simulation

# *************************************************

# Long-term variance

e_sigma2 <- omega / (1 - sum(alpha) - sum(beta))

# Starting point

Yt <- rep(mu, 2)

# Initialization

sigma2_t <- rep(e_sigma2, 4)

# Simulate standardized residuals

u_t <- rnorm(t_bar, 0, 1)

# Initialize residuals

e_t <- sigma2_t * u_t

for(t in 2:t_bar){

# ARCH components

sum_arch <- alpha[1] * e_t[t-1]^2

# GARCH components

sum_garch <- beta[1] * sigma2_t[t-1]

# Next-step variance

sigma2_t[t] <- omega + sum_arch + sum_garch

# Update simulated residuals

e_t[t] <- sqrt(sigma2_t[t]) * u_t[t]

# Update time series

Yt[t] <- mu + sigma2_t[t] * lambda + e_t[t]

}